The Problem

Positive movements are observed in the Waves ecosystem recently. Due to the support of the block generators who voted for the buyback activation, XTN is now feeling better and better every day. Also, the current L2 activities add more positive traction to it.

This increases the XTN market demand and causes some major price swings from time to time, i.e. the XTN price on the contract deviates from the market price.

Neutrino contract right now is out of the game because of the two factors: small swap limits and value of parameter k=1. Parameter k has major impact on the Sell (burn) operation in the following way: Sell XTN on smart contract is only profitable if the market price is below contract’s price more than k*D, where k=1 and D=5%.

What do you suggest to change?

The market situation is becoming more stable and predictable. Taking into consideration that the Buy XTN operation (issue) is disabled, there is no need to keep a big spread between issue and burn operations.

We suggest changing values of the existing “a” and “k” parameters of the XTN->Multi-collateral (Sell) direction. The current values are the following:

a = 0.0625

k = 1

We suggest changing to:

a = 0.2

k = 0

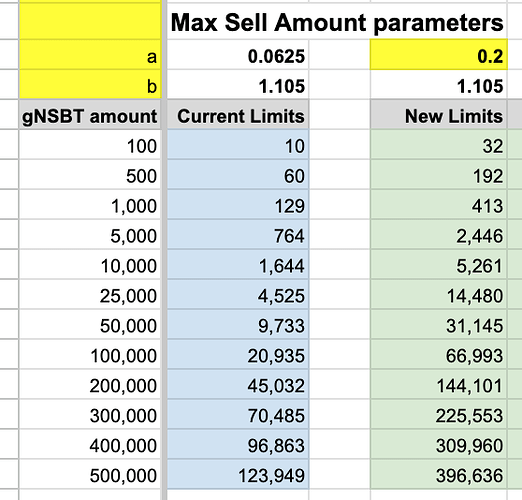

With the new “a” value, NSBT/SURF stakers will be able to sell ~3 times more XTN (which is equal to “burn” XTN) to the contract compared to the existing setup, which means that they can support the XTN market price and withdraw more XTN from circulation.

Please review how changing the parameter “a” affects the Max Sell Amount:

With the new “k” value, the spread between the Sell XTN contract’s price and the XTN market price becomes more narrow. When users swap XTN for multicollateral tokens, they will receive more of each token from the multicollateral reserves and at the same time can support XTN markets. We would like to remind you that k parameter has been introduced as a protection mechanism to negotiate the Issue/Burn process that can be used to drain contract reserves. Currently, there is no need for such protection because the issue operation has been disabled.