Hi

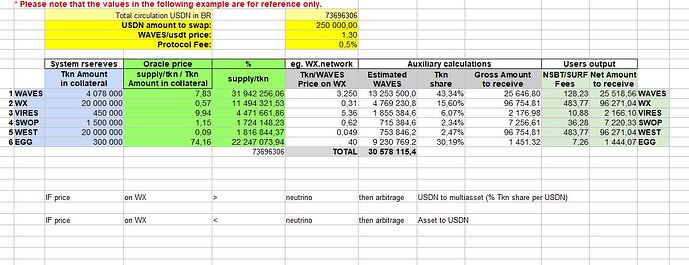

I have idea to count price of asset in collateral to circulation USDN (73mln at the moment).

Basicaly the price will be calculated in % adequately to the price on WX.Network but calculated for the general USDN circulation.

Example

Waves price on WX - 3,25$ and in Neutrino 7,83

Price in Neutrino is % of Token share in collateral / total circulation USDN in BR

Then that amount is devided by token amount in collateral.

In this example we have 31 942 256,06/4 078 000 what give us neutrino price index 7,83$

That difference give us opportunity to arbitrage and make swaps from WAVES to USDN then we can buy more Waves on exchange for smaller price and push price up to price from neutrino index.

In diffrent option if price neutriono index is lower then on WX.network we can arbitrage USDN to multicollateral (6 tokens adequate to fill the % of the collateral)

Thanks for reading and please give your feedback.