First of all, sorry for my english, if something is not explained correctly.

Of course this proposal is open to suggestions, considerations, modifications and improvements.

I think it is quite developed and fully explained but I could have missed something so please read it carefully and comment your opinions.

CURRENT SITUATION

For a few weeks it has been difficult for the Neutrino protocol to maintain not only the USDN peg with the USD, but also the to keep BR>1, especially lately due to the price declines of the entire market in general and of the WAVES token in particular.

At this time, the NSBT token should start being used to recolateralize the system, and bring the Backing Ratio back above 1.

However, it is being seen that something is not working quite right. Specifically, the price of NSBT in the Smart Contract (SC) is higher than the market price, so it is not interesting to swap WAVES for NSBT (unless they are really large sums of money so as not to have a big spread in the market).

This is due, above all, because the Moon Factor, as the Supply Max of the NSBTs is minted, makes the SC price tend to infinity, while it has been clearly seen that the market price has nothing to do with the price of SC.

This is incompatible with the process of recapitalizing the system and that is why I am making this proposal, to try to give a different idea that I think everyone will like.

PROPOSAL SUMMARY

Before extending the whole development, I am going to summarize the different points, to give an overview of the proposal so that it can be understood a little better.

- Remove the Moon Factor. As I said before, it is not compatible with recapitalizing process.

- Remove MaxSupply for NSBT or increase it a lot, since Moon Factor is no needed, neither is the Max Supply.

- Arbitrate BR to be between a range of values. I propose to take it between 1.2 and 2.4.

- To do so, change NSBT_SC_Price equation, making it depend on the NSBT_Market_Price and on BR.

Now I will explain the two last to understand it better. But general idea is to use NSBT to recolateralize the system, as it was designed at the beginning

MINIMUM BR AT 1.2 (from now min_BR)

The idea of having a minimum BR at 1.2 is to have a 20% overcollateralization, so that if it falls below that value, you can start arbitrating, but there is a margin for the BR to remain above 1. Arbitrators will have a discount of the market price for minting NSBT for WAVES at SC, then they can stake NSBT on SC or sell it on the market for a higher price, taking a quick profit.

1.2 is just an example, it can be changed any time, but I think is good having the 20% of margin to arbitrate the BR.

The problem with this is that NSBT market price would eventually fall if there is not a good reason to buy it. That’s why we need to limit te maximum BR.

MAXIMUM BR AT 2.4 (from now max_BR)

Having too much overcollateralization is not efficient, since the resources could be used for something better than having them as backup. I consider that having a BR of 2.4 is enough to consider the system safe. Of course that parameter can be changed any time.

To take advantage of these resources, I propose that USDN can be minted in exchange for NSBT in the SC, with a price higher than the market.

In this way, the arbitrators will buy NSBT in the market at a lower price than the SC, and will sell it for USDN in the SC at a profit.

This also creates buying pressure in the market, increasing the price.

Thus, when minting USDN, the Circulating Supply increases and the BR drops to 2.4 value.

NSBT SC PRICE

For arbitrating the BR values, it is necessary to change the formula that provides NSBT price in the SC, so it needs to depend on Market Price (provided by Oracles) and BR.

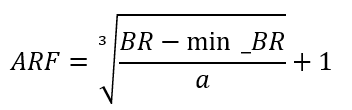

I propose the following equation:

![]()

Where:

- NSBT_SC: NSBT price in the SC

- NSBT_MK: NSBT price in the market, provided by Oracles.

- ARF: Arbitrage Factor. It is a factor that multiplies NSBT_MK. ARF will be less than 1 when BR<min_BR and greater than 1 when BR>max_BR.

Therefore, NSBT_SC price will be less tan NSBT_MK price when BR<min_BR and it will be greater than NSBT_MK when BR>max_BR, making it possible to arbitrate.

ARBITRAGE FACTOR

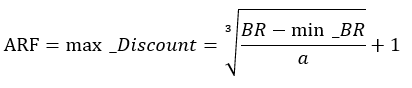

For the Arbitrage Factor we can follow different types of equations, from simple and linear to quadratic or cubic. However, I would like to propose a cube root equation, which I think would work very well, as I will explain graphycally now.

So continuing with the parameters of 1.2 and 2.4 for min_BR and max_BR, the equation would be as seen below.

Basically this is how it would work. On X axe we have BR and on Y Axe we have ARF value. Please note when BR=0 the ARF cannot be 0, so we’ll be giving NSBT for FREE.

ARF value depends on min_BR and max_Discount parameters. Those parameters determinate the starting profit when BR>max_BR. ARF equation is:

Where:

- ARF: Arbitrage Factor.

- BR: Backing Ratio.

- min_BR: mínimum Baking Ratio to start arbitraging. I think 1.2 would be a good value.

- a: is a parameter that depends on max_Discount. We can obtain it by setting the equation equal to max_Discount when BR=0 and solving it:

I think a good max_Discount parameter would be 50%, so for our parameters:

And then the price for NSBT on the Smart Contract:

Note that we could do it the other way around, equal the equation to the profit we want when BR gets max_BR, but then max_Discount will be determined and we cannot move it. I think doing like this, fixing max_Discount is quite better.

The price of NSBT in WAVES value it would be:

Where:

- WAVES_MK: WAVES price in the market in USD, provided by Oracles.

Here there is a table with different values of BR and the discount/profit given:

PROS OF THE PROPOSAL

- I think it would clearly help to keep the BR on the good values.

- It would help the decentralization of the protocol. Since it would make it interesting to use, buy, mint and redeem NSBT, taking it to more people.

- It would help to the scalability of the protocol. The more people owns NSBT, the more people who can redeem for USDN. The more USDN minted, pegged and well baked, bigger the protocol will become.

- It definetly would strength the protocol and would help the security. The more people who participate, the more strong it will be.

- Smart Contract would be more alive, so NSBT holders would get more rewards for staking.

- The whole thing depends on NSBT market price, so even when it changes so much, system would work.

CONS OF THE PROPOSAL

- Removing maxSupply and Moon Factor I think will not be well accepted. However, I need to say that having huge value on SC, if we cannot exchange it is useless. Also if Moon Factor makes recollateralizing imposible, then the protocol doesn’t work and in long term it will get worse.

- Equation for ARF cannot be the best solution, but I think it fits quite good. Also “a” parameter is not easy to get directly, but is not difficult to get with a calculator.

- When BR<1.2, NSBT price will definitely drop since arbitrators will start selling. This can give bad image of the protocol. But NSBT is not a tokent to go to the moon. It is a token to be used for voting and for recolateralization. Then when BR>2.4, price will increase considerably.

COMPARING DIFFERENT SITUATIONS

1. BR drops to 1.18 (BR<min_BR)

- Now it is possible to mint NSBT on SC cheaper than market price.

- ARF=0.87. That means there is a discount of % from the market

- Arbitrators can start to arbitrate BR to get it over 1.2 and take 13% quick profits.

- Locking WAVES will make BR go again over 1.2.

- Fees are paid to NSBT stakers.

- USDN is also arbitrated so fees for those transactions are paid to NSBT stakers aswell.

2. Big sells in market, BR drops to 0.75 (BR<min_BR)

- As before it is possible to mint NSBT on SC cheaper than market price.

- ARF=0.64. That means there is a discount of 36% from the market

- Arbitrators can start to arbitrate BR to get it over 1.2 and take 36% quick profits.

- Locking WAVES will make BR go again over 1.2.

- Fees are paid to NSBT stakers.

- USDN is also arbitrated so fees for those transactions are paid to NSBT stakers aswell.

3. BR=1.67 (BR between min_BR and max_BR)

- It is not possible to mint NSBT or USDN.

- USDN is also arbitrated so fees for those transactions are paid to NSBT stakers.

4. Good news for WAVES, it increases price, taking BR to 2.65 (BR>max_BR)

- Now it is possible to mint USDN with NSBT on SC more expensive than market price.

- ARF=1.53. That means there is a discount of 53% from the market

- Arbitrators can buy NSBT in the market and sell it on SC taking 53% quick profits.

- Increasing USDN Circulating Supply will make BR drop under 2.4.

- Fees are paid to NSBT stakers.

- USDN is also arbitrated so fees for those transactions are paid to NSBT stakers aswell.

As you can see, NSBT stakers get benefits on every situation, as the protocol does.

I hope you really take the proposal into consideration. Thanks for reading.